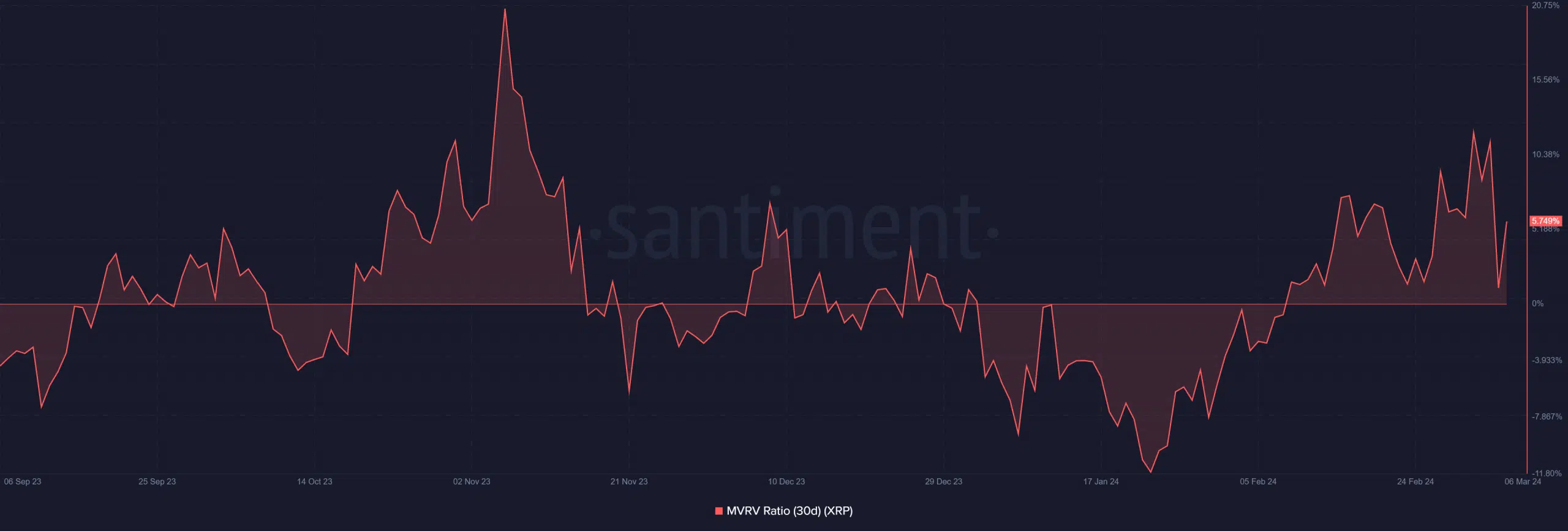

- A 30-day MVRV shows that XRP remains in the profit zone.

- Price has climbed back to the $0.6 price zone.

XRP has retraced following its recent uptrends, during which it ascended significantly into the $0.6 price zone. Additionally, there was a notable increase in volume, and changes were observed in the total supply in profit over the last 24 hours.

XRP dips by over 8%

On 5th March, XRP experienced a notable price decline, as a daily timeframe chart analysis revealed. The chart showed the price starting the trading day at about $0.64, but after an 8.6% loss, it dropped to about $0.59.

A chart review indicated a significant decline had not been witnessed for over six months. Furthermore, the analysis highlighted that this downturn brought XRP out of the overbought zone, as indicated by its Relative Strength Index (RSI).

However, at the time of this writing, the price demonstrated a recovery, experiencing over a 3.8% increase. It had returned to the $0.6 range, trading around $0.61.

Additionally, the RSI, which had fallen below 60 during the price decline, was now close to 60 at the time of this writing.

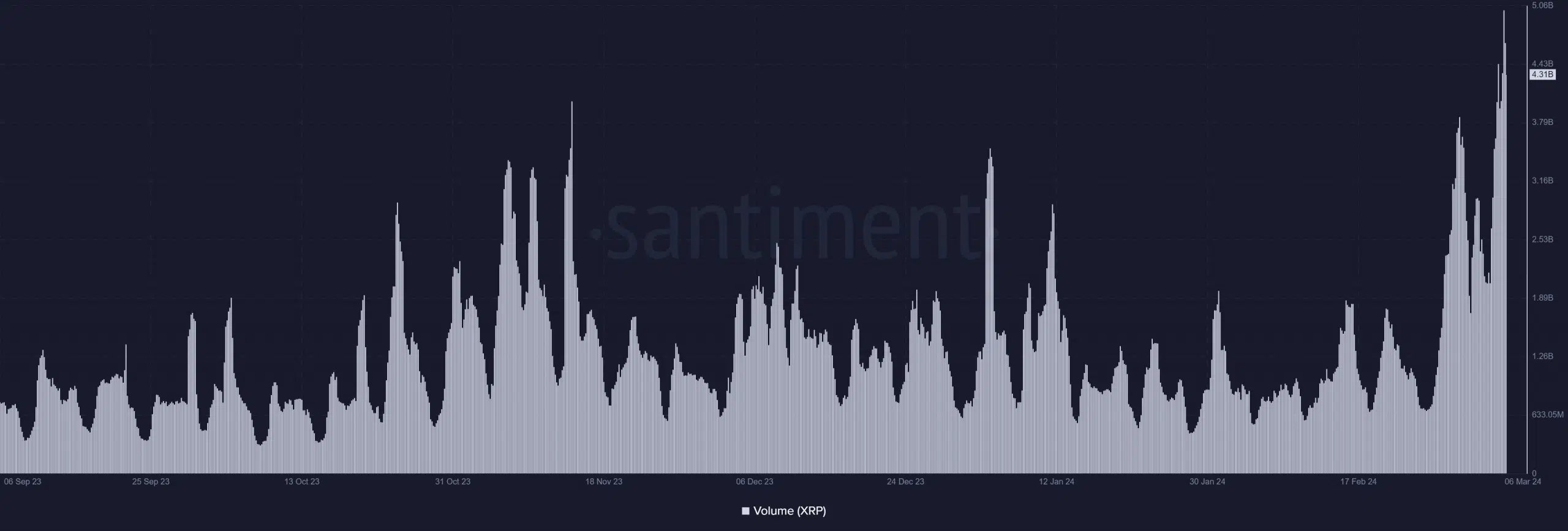

XRP volume spikes to a six-month high

In recent days, another noteworthy metric on the rise is the volume. Analysis of Santiment’s volume metric revealed sharp spikes and declines over the past few weeks but a consistent uptrend in the last 48 hours.

On 5th March, the XRP volume surged to about $4.02 billion. In the current update, it was around $4.3 billion, with indications on the chart reaching as high as $4.9 billion.

This suggests that the volume observed on 5th March, coinciding with the price decline, was predominantly influenced by sellers. However, in the latest analysis, buyers have taken control of the volume, contributing to a price increase as the volume rises.

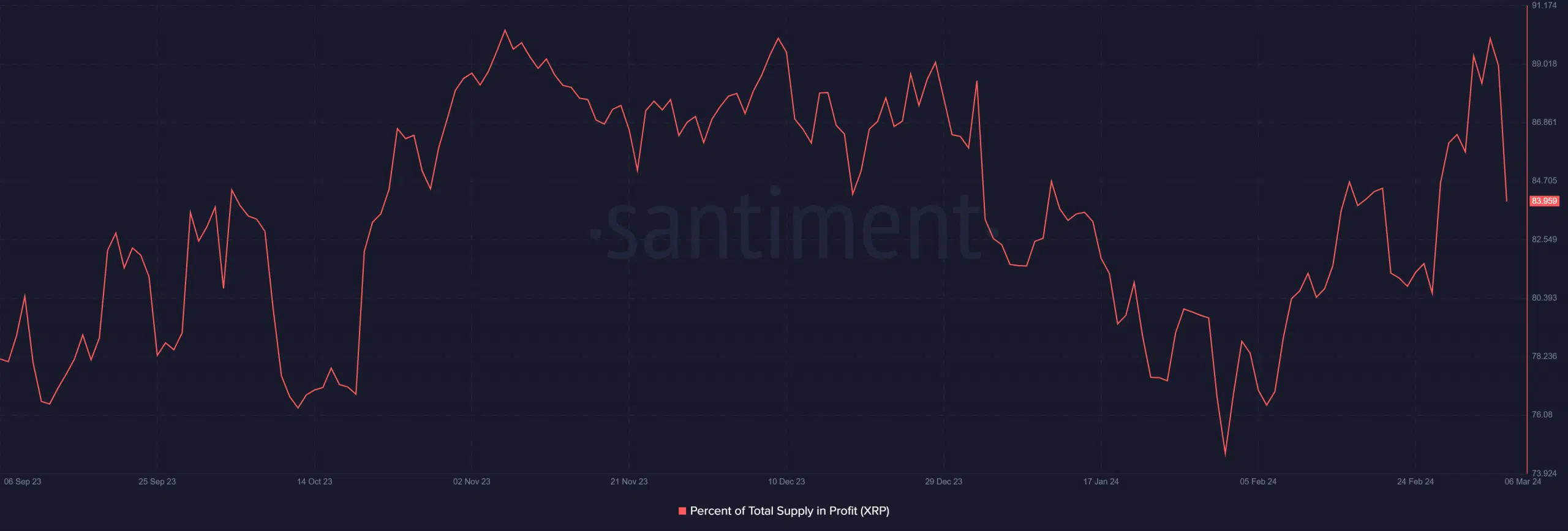

MVRV and supply in profit show profitability

Before the price decline witnessed by XRP on 5th March, its total supply in profit stood at nearly 90%. However, following the decline, the supply in profit has decreased to about 84% at the time of this writing.

The supply in profit chart showed that around 84 billion XRPs are currently in profit, compared to almost 90 billion before the price drop.

How much are 1,10,100 XRPs worth today

Furthermore, an examination of the 30-day Market Value to Realized Value ratio (MVRV) reveals fluctuations. As of 4th March, the XRP MVRV was about 11%, but with the price decline, it fell to around 1%.

At the time of this writing, it has rebounded to about 5%, indicating a dynamic market response to recent price movements.