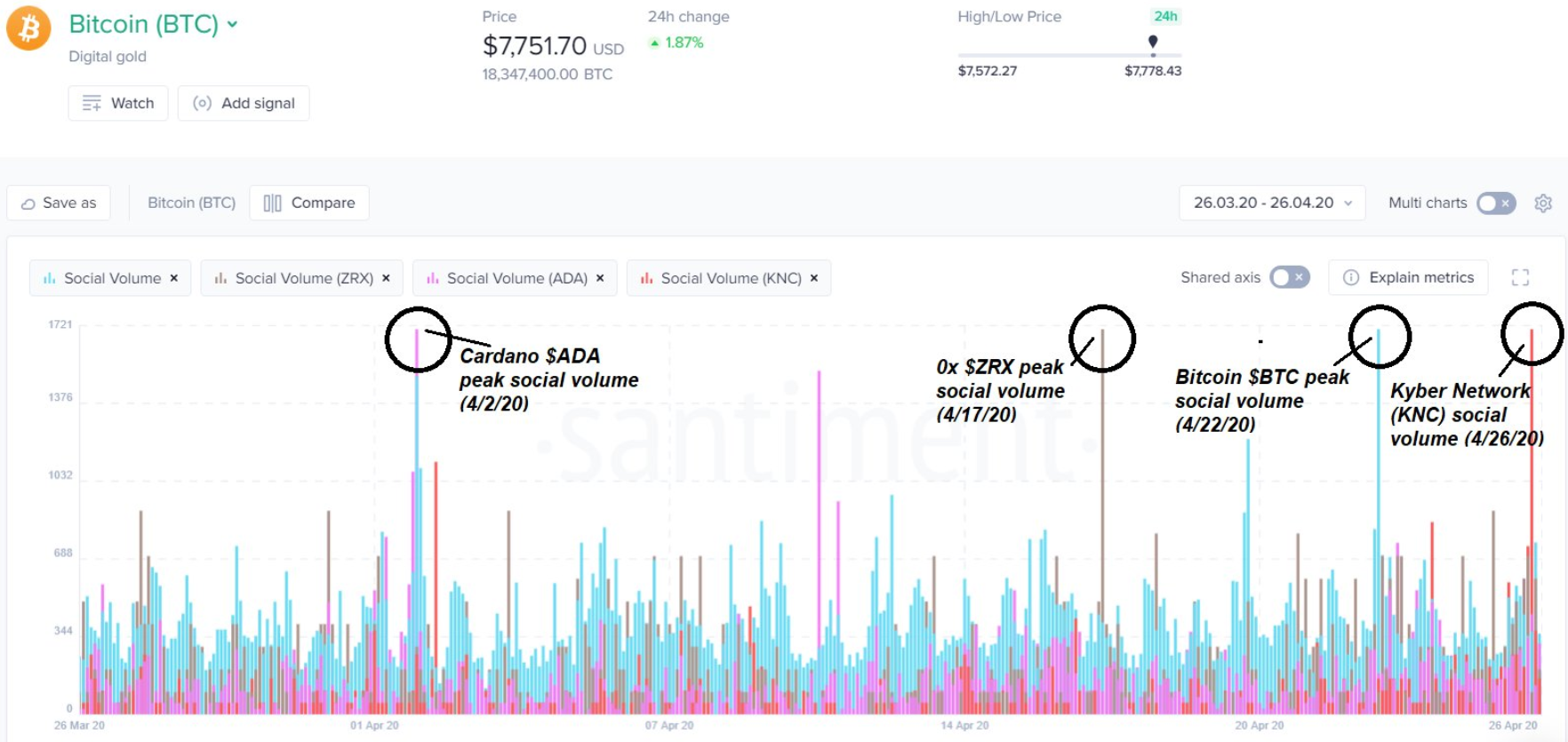

Kyber Network [KNC] surged to $0.69 on 26th April from $0.58, the previous day. Interestingly, it was also observed that there has been a rise in its blockchain’s social volume. According to the crypto analytic platform, Santiment, KNC witnessed a “month-high of enthusiasm” by the community. This is not surprising considering the fact that Kyber Network has posted dominating figures in terms of DEX usage.

Over the past couple of months, the network has seen a significant uptick in terms of trading volume and activity as Kyber Network witnessed a significant increase in the number of daily active addresses especially in the first quarter of 2020.

Source: Santiment

Despite a massive downside correction after the crash of 12th March, the figures with respect to total value locked [in USD] has gradually maintained an uptrend. In addition, according to data curated by website, DefiPulse, total value locked in Kyber climbed to $4.776 million.

However, Kyber Network’s centralization debates have cropped up in the ecosystem as well. This was evidenced by reports suggesting that 17 unique address held 57.65%% of all KNB tokens in existence, according to IntoTheBlock’s data.

The latest trend in rising social volumes, however, pointed towards a potential local top that, notably, was achieved as the coin climbed all the way to $0.75. While its tryst to this level was brief, it was crucial primarily because it was a month high.

Source: Santiment

It’s not just KNC that has seen a positive trend in terms of social volume. Cardano [ADA] was another altcoin that saw volumes rising on an otherwise flat Sunday.

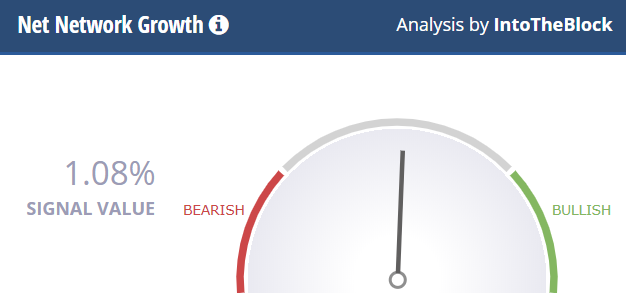

With respect to the price of the coin, the Net Network Growth, the momentum signal which indicated the underlying network health of ADA, also signaled a positive reversal.

Source: CryptoCompare | ADA